Heartview Foundation is a 501(c)(3) non-profit organization. Patient fees cover only a portion of the cost of providing patient care. We are dependent upon the generosity of those whose lives have been changed through us, whether it be a patient, friend or family, and those interested in furthering the field of addiction treatment.

Donations go directly toward helping our patients. A donation may be used to make it possible for us to treat a patient in need, to pay for patient activities while they are in residential treatment, to buy needed items used during a patient’s stay, or to purchase furniture or equipment for patient use.

A donation of any amount, big or small, will make a difference in the lives of those under our care. If you are unable to make a donation, but want to help out, please consider becoming a volunteer and providing your time to the Heartview Foundation or donating items.

Questions? Contact Ron at ronw@heartview.org or 701-751-5770.

Ways to Donate:

General Cash/Online Donation

*Venmo: @Heartview

*Form below

Benefits:

- Immediate impact on Heartview’s mission

- May be eligible for a federal income tax deduction

Endowment

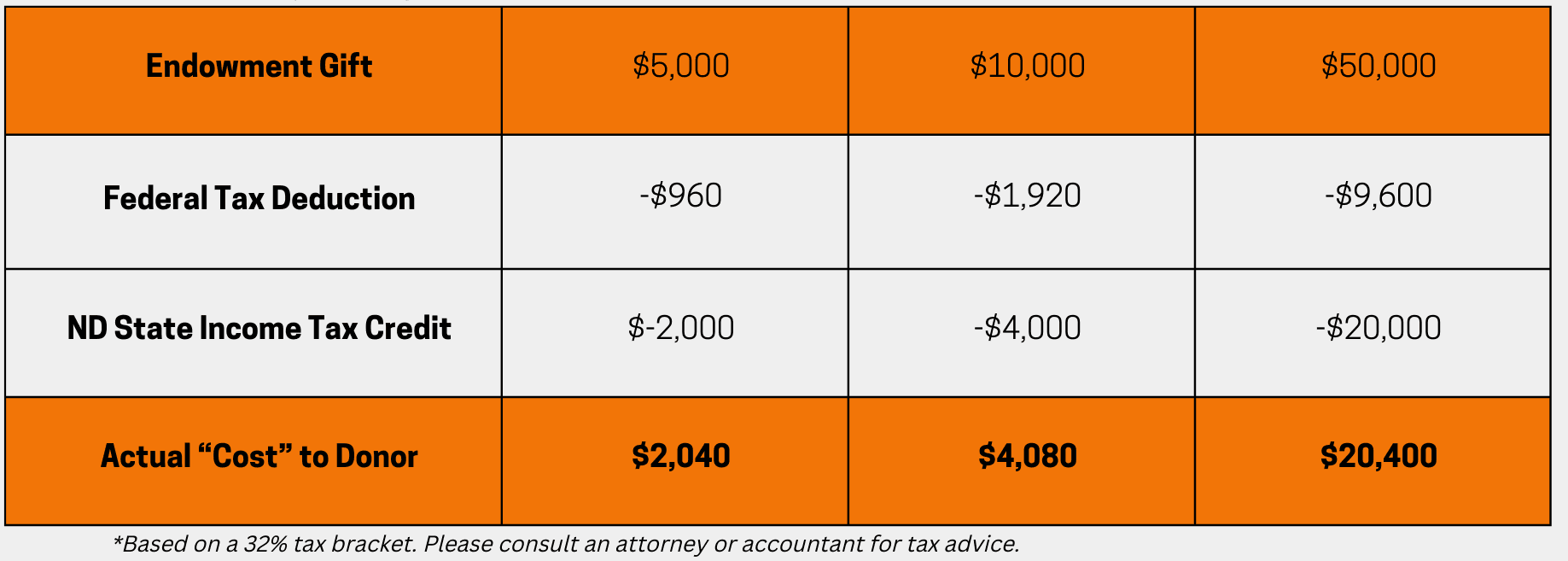

North Dakota allows individuals and businesses that make a contribution of $5,000 or more to a qualified endowment fund can receive a North Dakota state income tax credit of 40%, up to a total of $10,000. The tax credit is 40% of the charitable deduction allowed by the IRS up to a maximum credit of $10,000 per year per taxpayer or $20,000 per year per couple filing jointly.

Example*: